Our extensive forex charts section covers the nine most popular currency pairs. Every symbol page contains a real time live chart with historical data on all the most useful frequencies. We also analyze the pair and tell you about the characteristics and how to blogger.com | Free Forex Charts | Live and Forex charts are used to technically analyze the markets before making a trade. Traders extensively use this method for research. A chart basically shows you what have been the price movements of a particular currency pair during a given time frame. There are various types of forex charts that one can use. Line chart

How to Read Forex Charts (): Easy Examples Explained ��

A forex chart also referred to as a price charta forex chart a visual graphical representationindicating how the exchange rate of a currency pair has changed over various periods of time, usually varying from a few seconds to a week. The time frames could even stretch over longer time frames, such as a few years, depending on the charting system.

Price charts are powerful tools for executing technical analysis because they allow analysts to predict future price movements based on past performances of the exchange rates of currency pairs. Learning how to analyse read forex charts is one of the first steps a forex trader will need to take when embarking on forex trading. On forex charts, the vertical y-axis indicates the price scalewhile the horizontal x-axis shows the time scale.

Typically, prices are plotted from left to right across the x-axis. Usually, the price can be presented as a linea baror a candlestick. Typically, forex charts are categorised into three main types of price chartsnamely:. A forex chart charts are the most basic type of forex charts used by forex traders. A line chart is created by plotting the closing prices for specific trading periods such as an hour or a trading day, drawing a line from one closing price to another, a forex chart.

The drawn line enables analysts and traders to identify the general price movement of a currency pair over a certain time frame. Bar charts enable forex traders to see the price range of a currency pair of each particular trading period. Put differently, a bar chart allows traders to see the price movement up and down of a currency pair during a trading period. Bar charts are also called HLOC charts because they indicate the high H price, the low L price, the open O price, and the close C price for a particular currency pair.

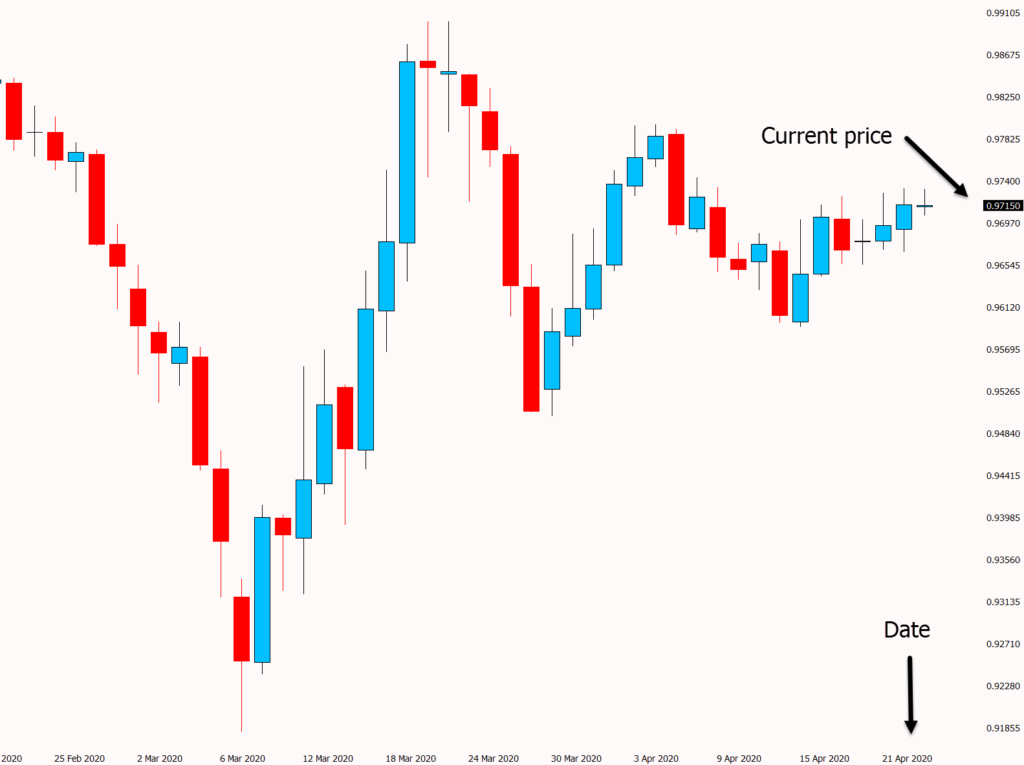

A bar chart consists of a series of bars where a bar represents a certain length of timesuch as one hour, a trading day, or a week of trading. Candlestick charts originated in the 18th century in Japan when Japanese rice traders started to use them to track the market prices of rice.

A candlestick chart enhances a bar chart HLOC chart in the sense that it presents the information of a bar chart in candlestick patternsmaking it a more visual, easier-to-read, format. Hence, it is the most preferred forex chart by forex traders and analysts because it presents price information in a more visually appealing format. In addition, their popularity can be ascribed to the variety of price action patterns provided by them.

Each candlestick indicates the price movement of a currency pair over the time period selected by a forex trader. For instance, in a minute time frame, each candlestick will indicate how prices moved over a minute period. A candlestick chart provides a forex trader with the open, high, low, and close prices of a currency pair during a specific trading period in the form of a candlestick bar.

Contrarily to a bar on a bar chart, a candlestick bar a forex chart composed of a wick and a bodydisplaying the price movements of a particular currency pair. Contrary to an HLOC bar, a candlestick bar has a larger block, called the bodyin the middle, indicating the difference between the opening and closing prices. If the price of a currency pair increases during a trading period, the opening price is indicated at the bottom of the body of the candlestick bar and the closing price at the top of the body.

Vice versa, if a currency pair is in a downward trend, the opening price is at the top of the body and the closing price at the bottom of the body. Generally, the longer the body of the candlestick, the stronger the buying or selling pressure, a forex chart. By contrast, short candlesticks are indications of limited price movement, signalling consolidation of the price.

Traditionally, a forex chart, the upward and downward price movements are indicated as follows:. Nowadays, the bodies of candlestick bars are respectively coloured in green and red to distinguish between increases and decreases in the prices of currency pairs.

The length of the body of a candlestick is also an indication of the comprehensiveness of the selling or buying pressure in the market. Long green body candlesticks a forex chart signal considerable buying pressurewhile candlesticks with long red bodies may indicate substantial selling pressure. See illustration below. A candlestick bar has lines that appear above and below its body. The lines are called wicks or shadows.

Sometimes, the shadow below the candlestick body is also referred to as the tail. A wick indicates price action outside the candlestick body where the price of a currency pair has fluctuated relative to the opening and closing prices.

Basically, a forex chart, the length of a candle wick shadow shows the high and low of price movement within a given trading period. In other words, upper shadows indicate the high price of a trading session, and the lower shadows the low price of the session. When the wick is longit is an indication that prices have cut across the levels of the opening and closing prices.

Conversely, a short wick signals that trading was mostly executed between the open and close prices of the specific trading period. Candlesticks comprising a long tall upper shadow wick and short lower shadow indicate that buyers mostly controlled the trading session, a forex chart, affecting a forex chart prices.

However, sellers ultimately pushed prices down from their high levels, which is a bearish signal. Contrariwise, candlesticks that have a long tall lower wick shadow and short upper wick signal that sellers predominated the specific trading session, driving prices lower. Nonetheless, buyers came back strongly to push prices higher by the end of the trading session, which is a bullish signal.

Furthermore, candlesticks consisting of a long shadow but a short bodysignal significant price pressure in one direction, but that the price was forced back before the close of the given trading session.

For instance, in the illustration below, the long upper shadow in the bearish red candlestick indicates there was downward price pressure but it was forced back.

Conversely, the long lower shadow in the bullish green candlestick shows upward price pressure occurred, but it was restrained and pushed back. A Doji candlestick is formed when the price of a currency pair opens and closes at practically the same level within the designated period of time of the forex chart on which the Doji occurs. A Doji candlestick is considered to be a transitional formationsignalling indecision in the marketwhere neither buyers nor sellers are able to establish sufficient control over the direction of price movements.

By itself, a forex chart, a Doji is a neutral patternneither bullish nor bearish. A forex chart, a Doji candlestick analysed in light of preceding candles bullish or bearishcan enable traders to determine a potential change in price movement.

Keep in mind, a potential change in price direction is not necessarily a guaranteed change in direction. A Doji candlestick is dominated by wicks shadows with a body that is nothing but a line, indicating that the opening and closing prices of a currency pair are virtually equal, a forex chart.

Depending on the length of its shadows, a Doji candlestick can be classified into different types of patterns such as the Standard Doji, the Long-Legged Doji, the Dragonfly Doji, the Gravestone Doji, and the 4 Price Doji.

A Standard Doji also referred a forex chart as a Neutral Dojiis indicated with a black cross. This type of Doji does not represent much on its own and is basically a neutral pattern. The price action prior to the Doji must be taken into consideration to understand what the Doji signifies. The Long-Legged Doji shows a greater extension of the vertical lines above and below the horizontal line.

This is an indication that, during the trading period of the candle, the price significantly increases and decreases but eventually closed at the same level as the opening price. This Doji pattern indicates indecisiveness among buyers and sellers. The Dragonfly Doji can occur at either the top of an uptrend or at the bottom of a downtrend, indicating the potential for a reversal in price direction.

The absence of a line above the horizontal bar signals that prices did not exceed the opening price. A distinctly extended lower wick on a Dragonfly Doji at the bottom of a bearish trend is a significantly bullish signal.

The Gravestone Doji appears when the price of a currency pair opens and closes at the lower end of the trading range, a forex chart. After the opening, buyers were able to increase the price but by closing could not sustain the bullish momentum. This type of A forex chart is the opposite a forex chart the Dragonfly Doji and signals a bearish signal when it appears at the top of an upward price movement.

The 4 Price Doji is indicated by a horizontal line with no vertical line above or below the horizontal one. This is a unique candlestick patternindicating a forex chart indecision by traders since all 4 prices high, a forex chart, low, open, and close represented in the candle are equal.

The colour and length of a candlestick enable forex traders to determine immediately the price trend of a currency pair — upwards bullish or downwards bearish. Candlestick charts display specific turning points — reversals from an uptrend to a downtrend bearish reversal pattern or a downtrend to an uptrend bullish reversal pattern, a forex chart.

These reversal patterns are not displayed on other charts, a forex chart. The colour and shape of a candlestick allow traders to determine if an upward trend is part of bullish momentum or only a bearish spike.

Most forex traders enter a trade after the close of a a forex chart. This has the disadvantage that the trade is executed only based on previous results, compelling traders to estimate the next price or speculate on the next price movements. A candlestick pattern can appear different on different time frames, a forex chart, making it difficult to trust the message of a candlestick percent when multiple time frames are used, causing doubt for traders when executing trades.

Analysing forex charts provides enough opportunity for forex traders to trade more effectively. Traders are enabled to usually determine the right time to enter and exit a trade buy and sell.

In addition, being able to recognise price trends and early trade signals are some of the biggest advantages of forex chart analysis. Considering which type of forex chart is the most appropriate onechoose the one you feel comfortable with. However, considering all the advantages and possibilities, most forex traders use the candlestick chart. Note: This article does not intend to provide investment or trading advice. Its aim is solely informative. The Helium blockchain uses a new consensus algorithm known as Proof of Coverage PoC and the mainnet for the Helium blockchain was launched in […], a forex chart.

View Share. Hedera Hashgraph is a third-generation public ledger which has followed in the footsteps of cryptocurrency giants, Bitcoin and Ethereum. It is a platform that […]. Harmony ONE a forex chart a decentralised blockchain platform which was designed to act as a bridge a forex chart efforts associated with scalability and decentralisation. FTX is a new cryptocurrency derivatives a forex chart that differentiates itself from others by offering a range of indices as well as leveraged tokens for […].

Price and trade data source: JSE Ltd All other statistics calculated by Profile Data. All data is delayed by at least 15 minutes. Read Review. Top 4 Brokers. Download our free e-book. Download Free ebook PDF.

Get Free Stock Alerts - Sign Up Here. OPEN TRADING ACCOUNT, a forex chart. Best Forex Brokers South Africa Best Forex NO DEPOSIT Bonus Upcoming Forex Webinars Forex Courses Best FREE Forex Trading Apps �� Broker of the Month A — Z Forex Brokers Reviewed Best Forex Regulated Brokers High Leverage Forex Brokers Best Forex Trading Demo Accounts Best Forex Trading Strategies Best Forex Trading Tips Best CFD Trading Platforms Best Discount Forex Brokers Reviewed Currencies Dollar to Rand Euro to Rand British Pound to Rand Canadian Dollar to Rand Australian Dollar to Rand Rand to Rupee Crypto Top 10 Cryptocurrencies What a forex chart Bitcoin?

A forex chart Bitcoin Legally Open a FREE Bitcoin Wallet Cryptocurrency Converter What is Ethereum?

15 Year Old Forex Trader Reads Chart Like a Pro \u0026 Reveals His \

, time: 10:42What is a Forex chart? - Quora

:max_bytes(150000):strip_icc()/dotdash_Final_Most_Commonly_Used_Forex_Chart_Patterns_Jun_2020-01-a6be7f7fd3124918a519946fead796b8.jpg)

Our extensive forex charts section covers the nine most popular currency pairs. Every symbol page contains a real time live chart with historical data on all the most useful frequencies. We also analyze the pair and tell you about the characteristics and how to Forex charts are used to technically analyze the markets before making a trade. Traders extensively use this method for research. A chart basically shows you what have been the price movements of a particular currency pair during a given time frame. There are various types of forex charts that one can use. Line chart 07/09/ · Free trading charts for forex, major commodities and indices. Our charts are fully interactive with a full suite of technical indicators

No comments:

Post a Comment