Thank you for downloading “6 Simple Strategies for Trading Forex”. This book is designed for beginning, intermediate and advanced traders. The presenters in this book are leading experts in trading the Forex market. As a bonus, you will also be exposed to a chapter on Trading Psychology and how to trade Forex pairs on the Nadex exchange 21/6/ · Using multiple signals will make it easier to create a dynamic trading strategy. If you want to try for free a trading strategy based only on the RSI indicator, see the RSI Trading Strategy to help you land great trade entries.. The money flow index indicator is not to be confused with the smart money flow index by Bloomberg or WSJ money flow Your trading Plan will be just like a flight plan it will keep you on target toward your goals Review your trading plan every time you trade and stick to the plan. You may have all the knowledge out there and be able to talk the talk but if you do not have a trading plan on how to use your knowledge then you will never be successful

How Do You Trade Forex Like the Banks? | FXSSI - Forex Sentiment Board

Trade forex like the banks pdf, get ready to learn what supply and demand trading is all about. Before we get to grips with supply and demand as a strategy, we need to talk about the supply and demand as a concept. When you buy a house, supply and demand determines the price, which is governed by various economic factors.

These factors cause the forces to increase or decrease, impacting the price. If a country has a declining birth rate, house prices 25 — 30 years down the road will be lower, trade forex like the banks pdf. If demand is low with lots of supply housesprices must fall to incite interest from buyers. Now Forex, as well as all other markets, stocks, commodities, crypto, etc, are driven by this same concept.

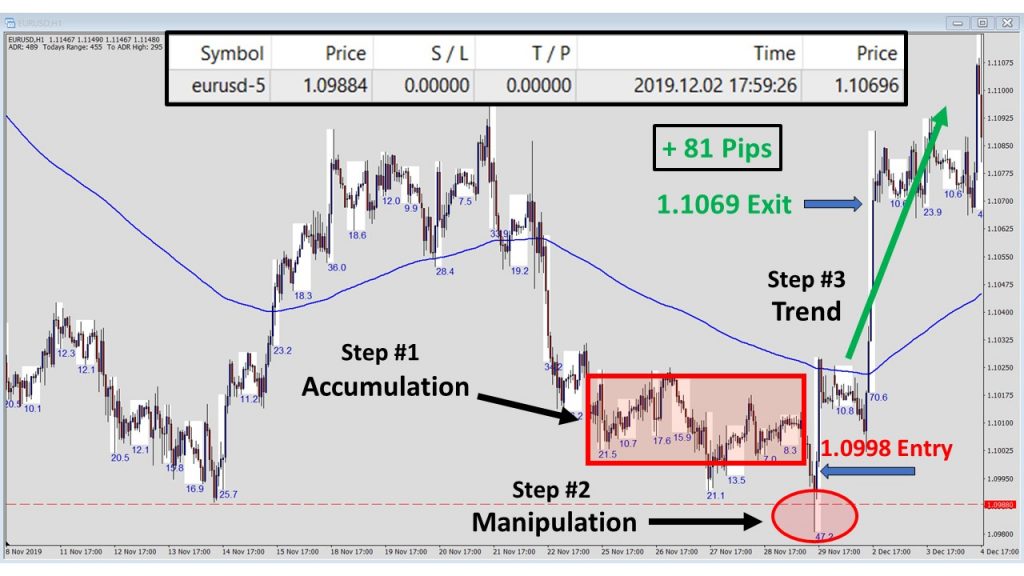

News events, economic announcements, and general market action cause different groups of traders to buy and sell, resulting in changes to the supply and demand equation. These changes manifest visually as the rises, declines, and consolidations we see on our charts. Observing the previous image, you can easily see how changes in trade forex like the banks pdf and demand create the moves we see. First: supply and demand are in relative balance, resulting in a consolidation. Supply is equal to demand.

Second: for whatever reason, something changes, and supply suddenly outweighs demand. Third: demand really comes in and pushes price higher, setting off a new upswing.

This continues before equal supply enters the market and creates equilibrium. With supply and demand now in relative balance, price moves sideways, and we see a tight consolidation form. Of course, it also goes on hour, half-hour, quarter-hour, 5-minute, 1-minute, and yes, etc. How does the concept of supply and demand create a trading strategy we can use to anticipate where and when major market changing reversals could begin in the future?

Changes in supply and demand ONLY OCCUR when the big traders buy or sell, trade forex like the banks pdf. Their positions are so large they must break them into smaller chunks and place each trade individually, around a similar price, to avoid pushing price away and potentially forcing their following entries at a worse price. This way they achieve the effect of placing one huge position, by placing a bunch of small ones instead. Their positions are often so big that not enough people exist on the opposite sidetrade forex like the banks pdf, to get them placed, trade forex like the banks pdf, even if they break them down into smaller chunks.

The banks need thousands of other traders completing the opposite action for them to enter their positions; buying if they want to sell, or selling when the banks want to buy. To compensate, they must let price move away and make it return later to get the rest of their position entered. Next: the banks make price return to the source, the point they placed their initial position. That way, they can enter their remaining positions like trades at a similar price, replicating placing one total position into the market.

In supply and demand trading, our job is to locate and trade these points where the banks enter their positions. That will give us a low-risk entry with a very favourable risk to reward ratio, trade forex like the banks pdf.

Demand Zones represent points where the banks have placed a significant number of buy positions. Demand Zones form when the banks place a large number, or size, of buy positions. This creates excess demand, and results in the price reversing and moving higher. Supply zones are points where the banks place a significant number, or size, of sell positions and these are the resistance points where price could fall.

Supply zones form when the banks decide to sell a large amount of currency. This selling creates an excess of supply, which causes price to fall, creating the supply zone. We can break these Supply and Demand zones down even further. Now, we need a quick discussion about the two types of supply and demand zones.

While supply and demand zones are the same thing, zones where price could reverse, the zones come in two types based upon whether they develop from a reversal or continuation, trade forex like the banks pdf. The two types are as follows: 1. Rally — Base — Rally RBR and Drop — Base — Drop DBD Zones. Rally — Base — Rally and Drop — Base — Drop zones Form, when price moves in one direction, Base, i. e consolidates or pauses, then Continues in the same direction. They develop from banks placing a small number of positions into the market.

That said; they can give you good trades here and there, especially if you know which zones to watch for in particular.

Rally — Base — Drop and Drop — Base — Rally zones Form, when price reverses direction, Base, trade forex like the banks pdf, then Reverse and set off a new swing. These zones form when one major swing changes to the other, usually caused by the banks buying or selling large quantities of currency.

Reversal zones are the ones you should be trading using Supply and Demand methods. Reversal zones are formed by the banks and other big traders placing huge buy and sell positions. These zones are much larger when compared to the much smaller positions they place to create continuation zones. If you want to be successful trading supply and demand, you MUST master the finding of high probability zones and correctly drawing them on the chart.

It takes time, practice, and experience to get this right: But, I know a couple of tricks that should make everything much easier. But, stay with me, because I know a method you can use to make finding zones much easier. Supply and demand zones are formed by the banks buying and selling large quantities of currency, right? These tell-tale signs reveal the banks are buying or selling a large amount of currency, which means a massive build of supply or demand must exist at the source of the rise or decline, trade forex like the banks pdf.

These rises occur when a huge imbalance exists between supply and demand. Demand is outweighing supply in this case. Those actions ALL require the banks to buy. Trade forex like the banks pdf reveal the banks have decided to take some action in the market, like place buy trades, which means price has a high probability of reversing once it returns to the source of the rise.

This is the demand zone. And with the zones marked, this is how it looks…. Right away, you can see how almost all the zones resulted in price reversing or at least caused a reaction of some sort. That gives you some trade forex like the banks pdf of how accurate the zones are at predicting when and where price could reverse.

To find supply zones we use the same process as with demand zones, only the other way around. Sharp declines occur when excess supply comes into the market, which happens when the banks sell. This means it is likely the price will return to the same point, the supply zone, so they can get the rest of their positions trade forex like the banks pdf. Again, almost all the zones cause some sort of price reaction.

Most result in a large reversal. But, a couple only cause minor declines, which last for two or three hours. It will take some practice to get good at finding the right zones. If you follow these guidelines, you will pick it up fast. The Next Step? Learn The 5 Rules For Trading Supply Demand Like A PRO Trader Take your trading to the next level. Sign up today to get my FREE E-Book and learn how the pro's trade supply and demand.

Also Includes: Supply And Demand Trading: The Definitive Guide PDF. Draw the zone too big and your risk will be higher. You must cover a larger area with the zone. Draw the zone too small, which is probably even worse, and price may not touch the edge before reversing. This will cause you to entirely miss the reversal and not get into a trade at all. To draw a demand zonefind a sharp rise where you think a zone has formed. Now you need to locate the source of the move.

The source is the point where this most recent rise originated. The point is where the banks placed their buy positions in this example.

If the banks still have positions left to place, they will bring the price back to this point. We need to cover it with a zone large enough to ensure price reverses within it. To draw this demand zone: open the rectangle tool from the tool menu, and place the rectangle on the MOST RECENT SWING LOW that formed at the source of the move.

Technically, the swing low represents where the banks placed their buy positions. The banks need sellers to buy from; remember, this is the key: opposing orders. If the small candle is bullish, mark it to the close. If the small candle is bearish, draw it to the open. The lower edge should sit on the most trade forex like the banks pdf swing low, and the upper edge should rest on the last small candle before the first big candle appeared — a small bull candle in this case.

But, it will cover the right price range and provide a valid trade if price reverses. We find the source of sharp decline : place a zone on the most recent swing highbringing it down to the last small candle that formed before the decline. If the banks still have positions left to enter, they will bring price back to this point to place their remaining positions at a similar price before causing the reversal. Once you have found the source: place the rectangle tool on the most recent swing high, drag the opposite trade forex like the banks pdf down to the LAST SMALL CANDLE that formed before price fell sharply and created the first big bear candle in the down move.

You can see the top of the rectangle rests on the swing high and the lower edge sits on the open of the last small candle before price fell sharply, which was a bear candle in this example. As trading strategies evolve, new ways of trading them get created. Sometimes these ways work better than the previous methods or better suit a particular style of trading. Supply and Demand has also gone through this process, and today, there are TWO different ways of trading the zones…. Popularized by Sam Seiden, the set and forget entry is the original way of trading supply and demand.

How To Trade Forex Like The Banks using this Retail Trader Indicator!

, time: 15:07How to Know Where Banks are Buying and Selling in the Forex Market

10/5/ · Start Trading At least $10 k: Many peoples ask how much capital needed to start trading, the answer depend upon your situation how much you want to earn. In forex you are able to earn 5% - 10% weekly means monthly 20% - 40%. You invest $10 k you will earn on it monthly $ - $ 20/1/ · Trade forex, like the banks, means a lot of fundamental analysis. As more and more people show an increased interest in trading forex, intuitional entities like banks are equally active in forex trade. Indeed, they are likely to be engaged more because of money, power, and quality blogger.comted Reading Time: 8 mins Forex trading for beginners pdf. According to the Bank of International Settlements, foreign exchange trading increased to an average of $ trillion a day. To simply break this down, the average has to be $ billion per an hour. The foreign

No comments:

Post a Comment