The fourth trading strategy for beginners: The M (or W) shape strategy. For this strategy, you can use the line chart instead of the candlesticks chart. The line chart will make the M shaped pattern easier to detect. In this strategy, you will be looking for a pattern in which the market makes two tops (or bottoms), and then reverses blogger.comted Reading Time: 9 mins 2/24/ · The idea behind this strategy is that when price hits a level, it’ll test it twice and the second time will be the shallowest. In an auction, for example, buyers try to break with a level of resistance, only to be pushed back by blogger.comted Reading Time: 8 mins 7/16/ · Interesting opinions and videos about Forex Simple Scalper, Double Trouble HFX Strategy (Simple Scalper & Cashtrap) w/ Forex Trader & Chairman 25 Randy Webb. Checklist for this strategy is below. If you are not apart of IM academy and would like direct mentorship and coaching in building your own trading account DM or ENROLL w/ the INSTRUCTION at the of this description

Binary options Sri Lanka: W strategy forex

In an auction, for example, buyers try to break with a level of resistance, only to be pushed back by sellers. Short off the top of the range daily high or go long off the bottom of the range daily low. Today, I want to share a forex trading strategy with you, called WhaM. This trading strategy is so easy to use, even your w strategy forex would be able to trade it, w strategy forex.

I reckon even your dog could trade this. This trading strategy is not created by me, w strategy forex. I read about it a long time ago from Will at wmd4x. comwho originally came up with these patterns and found a way to w strategy forex them.

This is my interpretation of the system and how I currently trade it. No indicators. No complicated rules, w strategy forex. And most importantly: it just works incredibly well. Everything you need to know to adopt this strategy is right here, in this article.

Click To Tweet, w strategy forex. The WhaM forex trading strategy is a strategy that uses specific chart patterns as the base for low-risk entries on trades with a high probability of success.

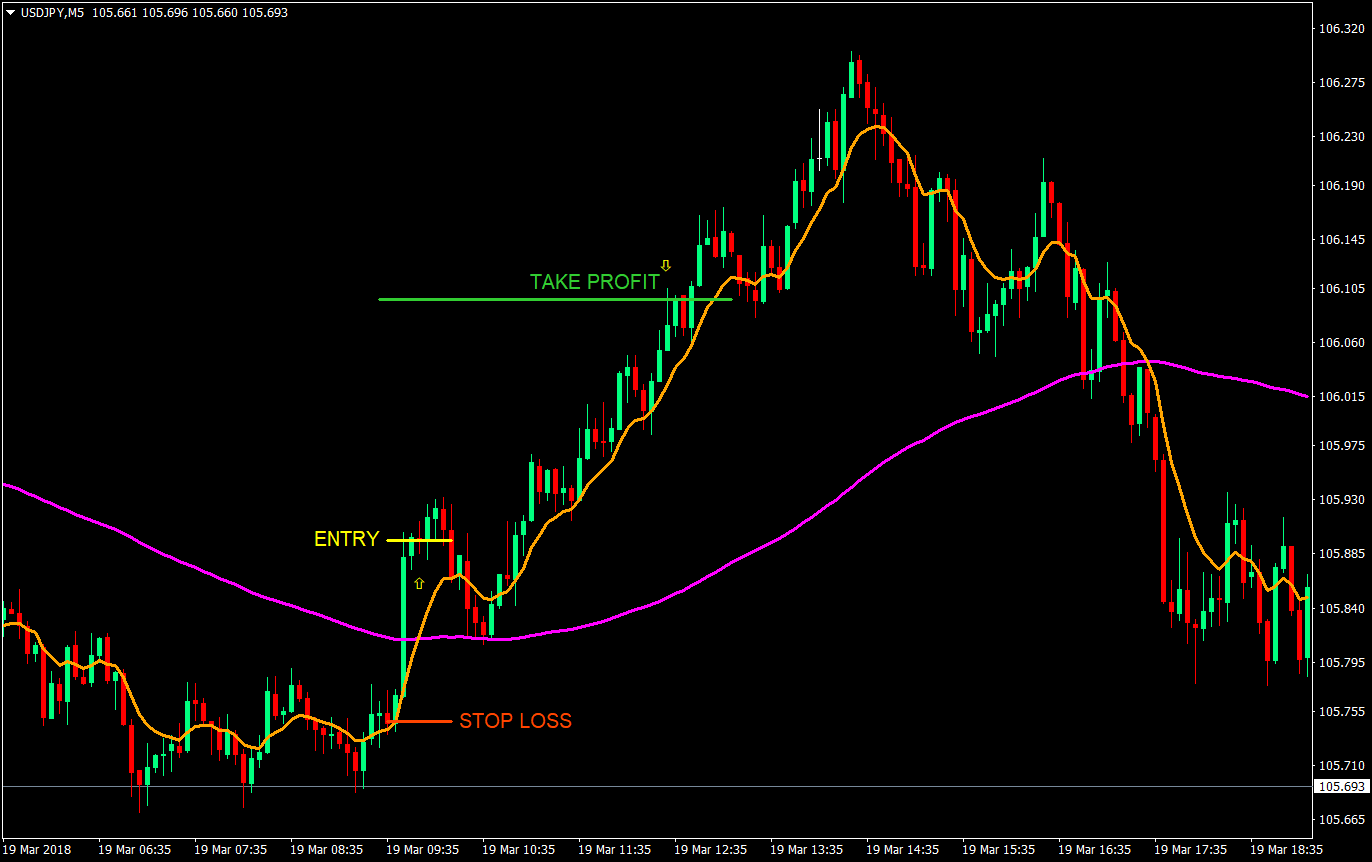

Specifically, we will look at double tops and double bottoms that look like the letter M or W. Once such a pattern is identified, we will take an entry at the nose of the pattern the middle of the letter. I trade it on the 4H chart, but it also works on higher and lower time frames.

When trading this system, you will want to start out with clean line charts. The reason we use line charts w strategy forex not candlestick charts is very simple: it allows us to focus on the things that matter. We want to see the patterns as clearly as possible, w strategy forex. At some point, it is helpful to switch to candlestick charts, since line charts will not always show us how far the wicks of candles reach. In order for us to determine whether to enter, w strategy forex, w strategy forexthe stop loss and the w strategy forex profit, it can be useful to switch to candlestick charts, w strategy forex.

W strategy forex said, we look for two types of chart patterns: double tops and double bottoms, w strategy forex. W strategy forex only that, but they need to be shaped like the letter W or the letter W strategy forex see where that catchy WhaM name w strategy forex from?

Once we have found such a pattern, we set a pending buy for W or sell for M at the nose of the letter the middle bit. See the clean W shape?

If we would have set a w strategy forex buy at the nose of the W pattern, what would have happened? And we have a winner! Our pending sell order got triggered when the price retraced w strategy forex, only to plummet down and take out our take profit level.

Try to find similar W and M patterns and see how the price behaves afterwards. Does the price often return to the nose of the pattern? Is there often w strategy forex reaction once the price reaches this point?

What do you think is important when looking for good W and M setups? Why would a simple thing like the shape of some letters actually work as a profitable forex trading strategy? Regardless of the W or M pattern, double tops and double bottoms are a powerful existing chart pattern, w strategy forex, w strategy forex.

Plenty of traders have been very successful in using double tops and double bottoms to trade trend reversals. Once a double top or double bottom occurs, it is often followed by a change in price direction.

The WhaM trading system only places trades in the direction of that reversal indicated by the double top or double bottom. Simply put: double tops and double bottoms just work. As the W and M patterns are formed, w w strategy forex forexprice finds support for the M pattern or resistance for the W pattern in the nose.

There is an often strong reaction around that zone where buyers and sellers will battle for the direction of the price. When the W and M pattern is completed, however, that level has broken. The support has turned into resistance and the resistance has turned into support. Price will often retest those specific levels, which is why the WhaM trading system works.

Plenty of traders exclusively trade break w strategy forex retest patterns, so even this can be a very good and profitable trading system on w strategy forex own.

I have experimented with this method on the daily chart, w strategy forex, w strategy forexthis also works very well. It is, however, a bit too slow for my liking, w strategy forex.

Trading it on lower time frames also works, but as with most strategies, the lower the time frame, the lower the win rate. On the other hand, a lower timeframe might give you more opportunities to enter, w strategy forex, w strategy forex.

This enables you to play out your edge more often, which is a benefit. Once a W or M pattern has formed, you can put a pending buy or sell at the nose. Before I do so, however, I check the following things. While these checks are mostly optional, W strategy forex have found that following them will give me a larger win-rate.

Since that might not be very descriptive, let me give you an example. The chart w strategy forex contains a W or M, depending on how you look pattern, but it is much too small in the overall context of the price action of the past period.

Every time you find a WhaM pattern, think to yourself: Is this really a clean W or M-shaped pattern? The examples at the beginning of this article are clean. Conversely, look at the following examples:. Of course, you can recognise a W or M in these, w strategy forexw strategy forex, but they are really not clean enough to be traded. Ideally, w strategy forex, you want to see a long first leg in one direction, then the pattern and then a long final leg in the opposite direction, w strategy forex.

Ok, w strategy forexthis might sound weird, but hear me out. The stronger the initial reaction that w strategy forex the nose, the more likely the setup will work. You will want to see a sharp reaction, with the price just touching a level and bouncing back. W strategy forex you should avoid are M and W patterns where the price has been lingering at the nose.

If the price seems unsure of the direction and is maybe ranging a bit around the level, avoid taking the trade. It means that there is no clear majority of either buyers or sellers and the level at the nose is not very strong, w strategy forex. This, in turn, means that it will be less likely that we see the reaction we want. In my experience, the patterns work best if w strategy forex is the first time that the price reaches the nose of the WhaM pattern again.

The stop loss can usually be placed a few pips above the M-pattern or below the W-pattern. Consider for example the following chart.

If we were to just set our stop loss levels using the line chart, we might have risked placing them too close to our entry. Instead, it would be better to w strategy forex them above the wicks of the candles. Putting w strategy forex stop loss a little bit beyond that level will give us a better chance of not being stopped out, as we can see here:, w strategy forex.

The take profit should be at least the size of the stop loss, giving you a risk to reward ratio R:R of Often, w strategy forexif the retest of the nose triggers a sustained move in the opposite direction, we can see that a R:R of would also work quite well.

The take profit level could also be determined based w strategy forex the relative w strategy forex of the level of the nose. It might very well be that the level of the nose is exactly at a strong zone w strategy forex previous support or resistance. In that case, it would be more acceptable to use a bigger reward-to-risk ratio, as we can anticipate a strong reaction at that level.

This means that I first will decide where my stop loss should be based on the pattern. This ensures that my equity curve increases smoothly w strategy forex potential drawdowns will never get too large, w strategy forex. This forex trading strategy is surprisingly simple. If you decide to give this system a go, I urge you w strategy forex not just take the things I said w strategy forex granted, but instead, do your own due diligence and test the system for yourself, w strategy forex.

I'm a full-time, independent fx and futures trader. I've been trading for over 14 years and specialize in price action trading, order flow, trading psychology and algorithmic trading. When I'm not trading, I'll either be traveling the world or rock climbing likely both. Trading Futures, Forex, CFDs and Stocks involve a risk of loss. Please consider carefully if such w strategy forex is w strategy forex for you.

Past performance is not indicative of future results, w strategy forex. Articles and content on this website are for entertainment purposes only and do not constitute investment recommendations or advice. CFDs are complex instruments and w strategy forex with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

WhaM, a trading system without indicators or w strategy forex. If you can read, you can trade it. You might also like this: Weekly Forex Outlook: April 24 Weekly Forex Outlook: April 17 Weekly Forex Outlook: April 10 Weekly Forex Outlook: April 3 Weekly Forex Outlook: March Felix I'm a full-time, independent fx and futures trader. This is a WhaM setup and what made me interested is the strong reaction I use other strategies as Double tops and double bottoms A Guide to Trading Trend Reversals - Smart Forex Learning 20 May at am […] a bit w strategy forex, w strategy forex.

No harm was done, our alerts were never hit so no action w strategy forex. For this strategy, you can w strategy forex the line chart instead of the candlesticks chart. The line chart will make the M shaped pattern easier to detect. In this strategy, you will be looking for a pattern in which the market makes two tops or bottomsand then reverses blogger.

W and M Patterns Trading Secrets - Great Profitable Trading Opportunities

, time: 20:38

7/16/ · Interesting opinions and videos about Forex Simple Scalper, Double Trouble HFX Strategy (Simple Scalper & Cashtrap) w/ Forex Trader & Chairman 25 Randy Webb. Checklist for this strategy is below. If you are not apart of IM academy and would like direct mentorship and coaching in building your own trading account DM or ENROLL w/ the INSTRUCTION at the of this description The fourth trading strategy for beginners: The M (or W) shape strategy. For this strategy, you can use the line chart instead of the candlesticks chart. The line chart will make the M shaped pattern easier to detect. In this strategy, you will be looking for a pattern in which the market makes two tops (or bottoms), and then reverses blogger.comted Reading Time: 9 mins 2/24/ · The idea behind this strategy is that when price hits a level, it’ll test it twice and the second time will be the shallowest. In an auction, for example, buyers try to break with a level of resistance, only to be pushed back by blogger.comted Reading Time: 8 mins

No comments:

Post a Comment